Tailored Credit Rating Counselling Providers to Help You Take Care Of Debt Efficiently

Navigating the complexities of handling financial debt can frequently be a tough venture for individuals looking for monetary security. By comprehending your unique monetary circumstance and creating a customized financial obligation administration strategy, these solutions offer a holistic technique to tackling debt head-on.

Understanding Your Financial Situation

Furthermore, it is vital to take supply of your possessions, consisting of savings, financial investments, and important possessions, which can potentially be leveraged to minimize debt worries. On the other hand, recognizing all exceptional financial obligations, such as credit rating card equilibriums, financings, and exceptional bills, is vital to gaining an all natural view of your financial obligations. By thoroughly examining your monetary circumstance, you can pinpoint areas of renovation, develop a sensible spending plan, and develop a customized debt management strategy to attain long-term economic stability and self-reliance.

Establishing a Custom-made Financial Debt Management Plan

Crafting a tailored debt management technique is crucial for individuals looking for to gain back control over their economic health and attain sustainable financial debt alleviation. To establish a customized financial obligation monitoring plan, it is important to start by collecting in-depth details regarding your existing economic circumstance.

Producing a budget is a fundamental step in crafting a customized financial obligation monitoring strategy. By outlining your revenue and costs, you can allot funds towards financial obligation settlement while guaranteeing that important prices are covered. Additionally, focusing on high-interest financial obligations can assist reduce the total interest paid with time. With the assistance of a credit counsellor, you can bargain with creditors, check out debt loan consolidation choices, and establish a sensible timeline for coming to be debt-free. By customizing your financial debt management strategy to match your private conditions, you can take aggressive steps in the direction of achieving monetary stability and long-term financial debt alleviation.

Implementing Efficient Budgeting Methods

To successfully manage your financial resources and work towards debt decrease, it is imperative to develop and implement effective budgeting methods that align with your monetary goals. Budgeting is a basic tool that allows individuals to track their revenue, expenditures, and cost savings methodically. Beginning by outlining your monthly revenue from all resources and classify your expenditures into dealt with prices (such as rent or home loan settlements) and variable expenses (such as groceries or amusement) Set apart between demands and wants to focus on vital expenses while determining locations where you can reduce. Establishing particular financial goals, whether it's constructing an emergency fund, paying off debts, or conserving for a huge purchase, can provide a clear direction for your budgeting efforts - best credit counselling services. Frequently examining and adjusting your budget as needed is crucial to make certain that you remain on track and make progress towards your monetary goals. By carrying out tailored budgeting approaches that match your distinct economic situation, you can take control of your financial resources and lead the method for a much more protected financial future.

Understanding Just How to Work Out With Financial Institutions

Just how can people successfully bargain with lenders to manage their financial debts and enhance their economic circumstance? Bargaining with lenders can be an overwhelming task, however it is an important action towards dealing with financial debts and accomplishing financial security.

It is essential to document all interaction with financial institutions, consisting of contracts reached during arrangements. By staying arranged and proactive in your negotiations, you can function towards fixing your financial debts and improving your monetary wellness.

Tracking Progression and Making Adjustments

After efficiently discussing with financial institutions to establish a workable repayment strategy, people must vigilantly monitor their progression and be prepared to make needed modifications to make sure continued monetary security. Monitoring progression includes routinely examining revenue, expenses, and financial debt balances to track exactly how well the repayment strategy is working. By contrasting these figures versus the preliminary budget and settlement objectives, individuals can recognize any type of inconsistencies or areas for renovation.

Additionally, individuals must stay aggressive in looking for financial support and education and learning to enhance their finance skills continually. By staying notified and adaptable, people can navigate with financial obstacles a lot more properly and function towards attaining lasting monetary health and wellness and stability.

Conclusion

Finally, tailored credit score counselling solutions provide individuals the opportunity to efficiently manage their debt by comprehending their economic scenario, developing tailored financial debt management plans, carrying out budgeting approaches, working out with financial institutions, and keeping track of development. These solutions provide a structured approach to financial debt monitoring that can assist people regain control of their financial resources and job in the direction of a debt-free future.

By comprehending your distinct financial circumstance and creating a tailored financial debt administration plan, these services offer an all natural technique to tackling financial obligation head-on. By meticulously examining your economic scenario, you can determine locations of improvement, establish a practical spending plan, and formulate a tailored debt monitoring strategy to accomplish long-term financial security you can look here and freedom.

Crafting a customized financial obligation management approach is necessary for individuals looking for to regain control over their financial health and attain sustainable financial debt relief. By tailoring your financial debt monitoring plan to suit your specific scenarios, you can take aggressive steps towards attaining monetary security and long-term financial debt alleviation.

How can people effectively discuss with creditors to handle their financial debts and enhance their financial situation?

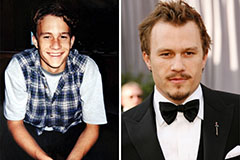

Heath Ledger Then & Now!

Heath Ledger Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Traci Lords Then & Now!

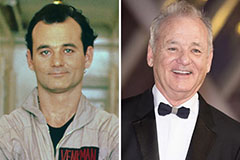

Traci Lords Then & Now! Bill Murray Then & Now!

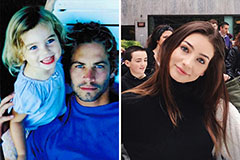

Bill Murray Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!